Over the past year and a half, BCG has published various surveys, reports and “opportunities for action” on research and development in India, China and other rapidly emerging economies. The most interesting data are in the Innovation Survey 2006.

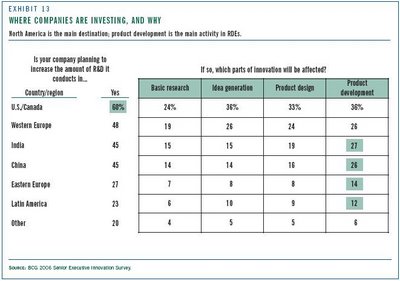

The largest target market for increased R&D spending remains the USA. And Western Europe still comes in second, albeit barely. India and China are rapidly becoming more important. About 45% of respondents said their company planned to increase R&D spending in China; and the same number planned to increase R&D spending in India. This is up from 2005, when only one-third of companies were planning to increase their R&D investments in 'rapidly developing economies.'

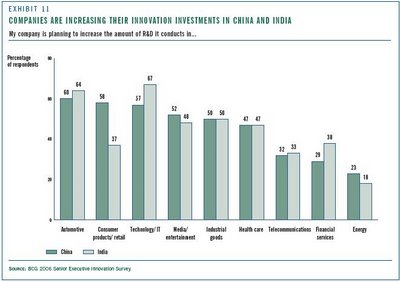

China draws increased R&D investments from significantly more consumer product/retail companies than India does. However in every other industry in the survey more or the same number of companies planned to increase their Indian R&D spending (see graph below). This comes as something as a surprise since it suggests stronger R&D growth for India than China. It is important to remember, though that China receives more foreign R&D investments in absolute terms - both FDI dollars and number of labs - and remains the most attractive location for future investments. (See UNCTAD's World Investment Report 2005 ch. 3-4.)

According to BCG's survey, cost – 34% of respondents – and localization (access to local markets) – 32% of respondents – are the main drivers for these investments. Access to R&D talent was mentioned by 21% of respondents.

The Economist Intelligence Unit (EIU) found similar drivers in their 2004 study but weighted them differently: Competition for talent, new technologies and easier market access have accelerated the process of R&D globalisation, with countries such as India and China hosting significant volumes of R&D activity for multinationals. Cost is a driver of globalisation too, but its significance can be overplayed as far as R&D goes. ... Speed of development is a more important benefit of the global research economy.

BCG also investigated the type of R&D being conducted in India and China. For anyone who's been watching the R&D space in Bangalore, Beijing and Shanghai it should come as no surprise that most of the investments are D rather than R. The main activity in India and China is product development, followed by product design. However, 15% of respondents said that their increased R&D spending would affect basic research and idea generation.

Conclusions

ConclusionsBCG encourages readers to reconsider the strategies in rapidly developing economies (RDEs), especially in terms of utilizing local talent to conduct more basic research and idea generation in these locations. This is somewhat at odds with the laments of companies that do engage in very high-end research: Development talent is plentiful, but research talent is very hard to find in most industries.

A note on the survey sample: Of the 1'070 respondents to the survey 450 were employed in the US, 71 in India, and 15 in China. The bulk of the rest were from Western economies. I wonder whether this skewed some of the comparative figures on India and China...

No comments:

Post a Comment